Praemium EOFY Information

In the lead up to June 30, we have outlined the important information you need to know about super changes for FY25 and the processing cut off times for Praemium Super, SMA and Private Wealth accounts.

For advisers please refer to the Help Centre for further information on End of Financial Year Reporting.

Super legislation changes for the new financial year

From 1 July 2024, the following changes will take effect;

Don’t forget, Notice of intent to claim or vary a tax deduction (NOI s.290-170) can be easily lodged online by your adviser. This is a straight through process removing the need for the manual ATO form.

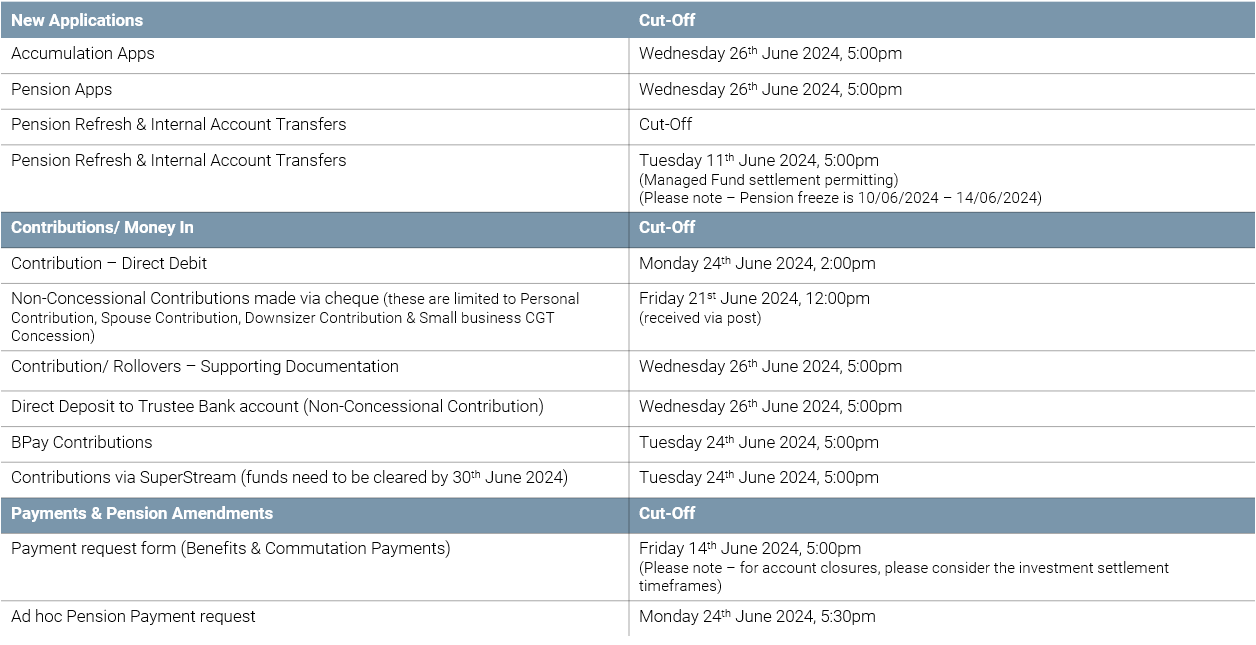

Cut-off dates for SuperSMA processing

All cut-off dates and times are in AEST and relate to when the instruction must be received by Praemium.

Further details on cut-off dates

|

New Praemium Super Accumulation Account Applications |

Applications must be received by 5:00pm Wednesday 26 June 2024. In order for a client to be admitted to the fund prior to 30 June 2024. Please note the cut-off dates for contributions and rollovers in the table above. |

|

Contributions/Rollovers - supporting documentation |

All appropriate supporting documentation (eg. Downsizer Contribution Form) must be received by 5:00pm Wednesday 26 June 2024. We recommend that you check with your bank for clearing times and allow plenty of time for funds to clear ahead of the cut-off date. Rollovers: Please keep in mind that some transferring funds can take over three weeks to deliver the member's benefits via a SuperStream message the fund has initiated, and the timing of receipt is outside of our control. Note that SuperStream clearing houses used for rollovers and employer contributions can have internal delays of up to six days. |

|

Benefit payments |

This includes account closures, rollover outs, contribution splitting and commutations. Instructions must be received by 5:00pm Friday 14 June 2024. |

| Ad hoc pension payments |

Ad hoc pension payments in June will continue to be available with the exception of the pension freeze from 10 June 2024 until 14 June 2024. The final cut-off for an ad hoc pension payment is not later than 5:30pm Monday 24 June 2024. |

Cut-off dates for Private Wealth & Smartwrap accounts

Please ensure you submit any requests prior to the stated deadlines to avoid any disappointment.

| Request type | Cut-off dates and additional notes |

| Account opening | Correct and complete applications received by COB 21 June 2024 will be actioned by 30 June 2024. |

| Asset transfers — ASX securities from 3rd party brokers (external transfers) |

Asset transfers received by 21 June 2024 will be

actioned by 30 June 2024. Neither Praemium nor our broker Finclear Execution are able to account for the requirements and requests of counter parties. |

| Asset Transfers - ASX securities between account at the same broker (internal transfers) | Asset transfers received by 21 June 2024 will be actioned by 30 June 2024. |

| Asset Transfers – Managed funds (with our custodian Clearstream) | We cannot provide cut off guidance for Off Market Transfers. Managed funds processing varies depending on the fund manager and pricing frequency. Off Market Transfers will be actioned on a best endeavors basis. |

| Asset Transfers – International securities/ Bonds | We cannot provide cut off guidance for in specie transfers of International and Fixed income securities as multiple parties are involved in the transfer process and completion depends on counter parties and/or custodians. |

| On platform managed funds |

Subject to fund manager deadline and

acceptance. Applications: 5:30pm 27 June 2024 Redemptions: 10:00am 28 June 2024 |

| Off platform non-custodially held assets |

Subject to fund manager deadline and acceptance. Any

instructions received after the below dates will be

actioned on a best endeavours basis. Monthly priced assets: 12:00pm 14 June 2024 Daily priced assets: 12:00pm 27 June 2024 |

| Leveraged Margin Lending |

New account and new asset transfers (new clients) 21

June 2024 Drawdown fixed rate loan (existing clients) 21 June 2024 Drawdown variable loan (existing clients) 21 June 2024 Asset transfers (existing clients) 21 June 2024 |

| Term Deposits in Custody | Open new: 10:30am 27 June 2024 |

| Australian Money Market (AMM) Term Deposits |

Open new: 1:30pm 28 June 2024 Maturity instructions: 1:30pm 28 June 2024 |

|

ANZ Direct Debit request ($50,000 and above) |

Direct debit requests received by 25 June 2024 will be actioned by 30 June 2024. |

Statement Delivery Dates

|

Managed Account Annual Statements |

Annual statements are issued to investors in August via Investor Portal. A notification will be sent to investors when this statement is available. |

|

SuperSMA Annual/Member Statement |

SuperSMA member statements are issued to investors by the end of December via Investor Portal. A notification will be sent to investors when this statement is available. |

|

Pension and Income Protection Payment Summaries |

Payment Summaries are issued for Pension members who have had PAYG withheld, and members in receipt of Income Protection insurance payments. These are issued to investors mid-July via Investor Portal. A notification will be sent to investors when this statement is available. |

|

Managed Account Tax Reports |

Tax reports containing information required to submit a tax return are issued to investors in September and October via Investor Portal. In order to have the most accurate tax information, these statements are issued once all trust information for the account has been received. A notification will be sent to investors when this statement is available. |

|

Private Wealth & Smartwrap accounts |

Annual investor statements are issued in September and Tax reports are issued to investors in October and November when these statements are available. An interim Tax report will be provided to investors in mid-November where tax components are still outstanding. |

Praemium End of Financial Year Guides

Webinar: Simplify your EOFY

Spend an hour with Praemium's Head of Private Wealth Relationships, Matt Walsh, as he shares with us his experiences working with some of Australia’s biggest and best financial advice firms and some of the tools they rely on to make sure they get it right for their clients, first time, every time.

In this session, we will be covering:

•

portfolio reconstruction for tax purposes

•

managing your client's investments based on their tax

goals

• considering managed accounts

as an efficient tax structure

•

ensuring your portfolio's tax position is accurate for

tax reporting, and

• superannuation.

Useful contacts

ATO Super enquiries

T 13 10 20

ATO Personal Tax enquiries

T 13 28 61

Centrelink Retirement Services

T 13 23 00

Centrelink Employment Services

T 13 28 50

Department of Veterans Affairs

T 13 32 54

Aged Care

T 1800 200 422